Firmy Canalys i IDC podały dane dotyczące sprzedaży komputerów PC, tabletów i Chromebooków w 4 kw. i całym 2022 r.

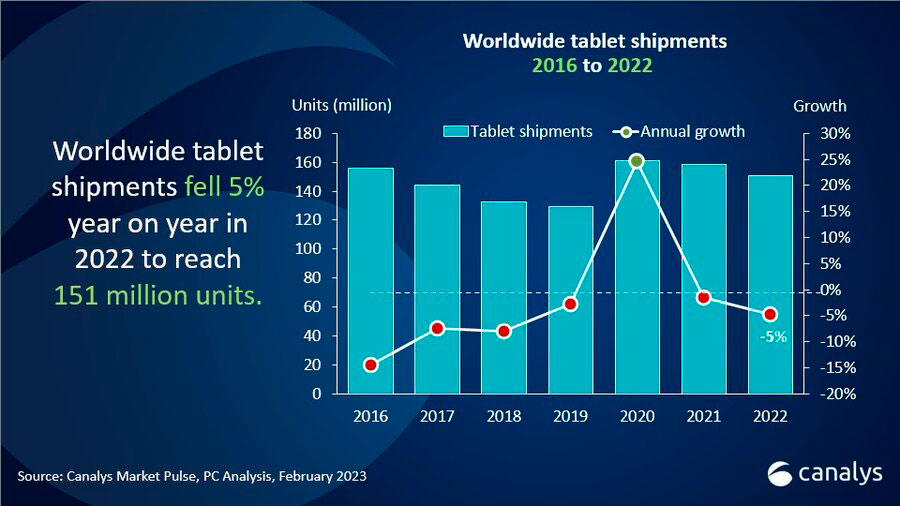

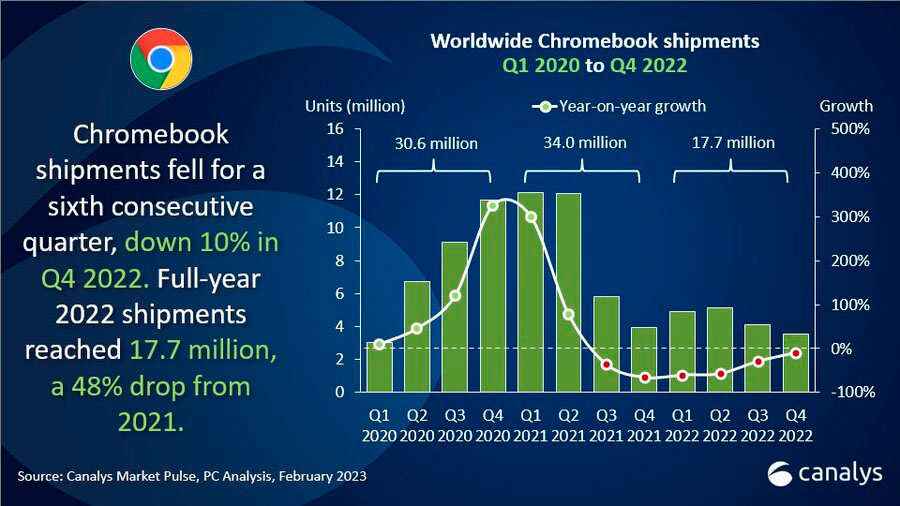

Najnowsze dane Canalys pokazują, że światowe dostawy komputerów osobistych (w tym tabletów) spadły o 21% rok do roku w czwartym kwartale 2022 r. do 105,6 mln sztuk. Dostawy komputerów i tabletów w całym roku 2022 wyniosły 434,5 miliona sztuk, co oznacza spadek o 13% w stosunku do 2021 roku, kiedy to sprzedano prawie pół miliarda urządzeń. Rynek tabletów okazał się odporny w czwartym kwartale, odnotowując wzrost dostaw o 1% do poziomu 42,3 miliona sztuk. Rok 2022 zakończył się sprzedażą 150,8 mln tabletów, co oznacza spadek o 5% w stosunku do 2021 r. Dostawy Chromebooków wyniosły 3,6 mln sztuk w czwartym kwartale 2022 r., co oznacza spadek o 10% rocznie. To dało dostawy w całym roku 2022 na poziomie 17,7 miliona sztuk, co stanowi spadek o 48% w stosunku do szczytów z 2021 roku.

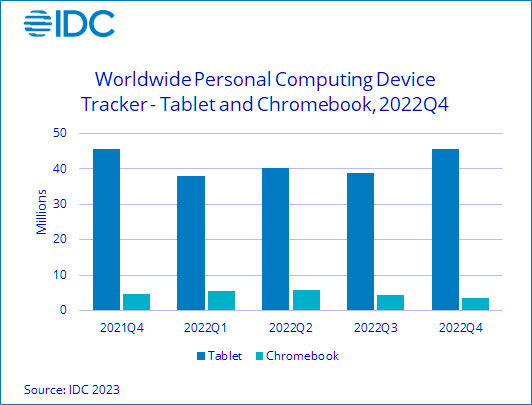

IDC analizowało w swoim raporcie wyłącznie rynek tabletów i Chromebooków.

Według tej firmy analitycznej światowe dostawy tabletów odnotowały wzrost o 0,3% rok do roku w czwartym kwartale 2022 r. (4Q22), w sumie do poziomu 45,7 mln sztuk. Przez cały rok 2022 rynek tabletów odnotował spadek o 3,3% rok do roku, kończąc dwa lata solidnego wzrostu, chociaż dostawy pozostają znacznie powyżej poziomów sprzed pandemii. Tymczasem dostawy Chromebooków nadal spadały w 4Q22, osiągając łączną liczbę 3,6 miliona sztuk, co oznacza spadek o 24,3% rok do roku. Dostawy za cały rok spadły o 48% w 2022 r. po wzroście o 180,5% w 2021 r.

Dostawy tabletów - Canalys - Q4 2022

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

19,480 |

46.0% |

16,443 |

39.2% |

18.5% |

|

Samsung |

7,612 |

18.0% |

6,899 |

16.5% |

10.3% |

|

Amazon |

3,566 |

8.4% |

3,948 |

9.4% |

-9.7% |

|

Lenovo |

2,334 |

5.5% |

4,742 |

11.3% |

-50.8% |

|

Huawei |

1,441 |

3.4% |

2,239 |

5.3% |

-35.6% |

|

Others |

7,916 |

18.7% |

7,633 |

18.2% |

3.7% |

|

Total |

42,349 |

100% |

41,904 |

100% |

1.1% |

Dostawy tabletów - Canalys - 2022

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

60,844 |

40.3% |

61,046 |

38.6% |

-0.3% |

|

Samsung |

29,024 |

19.2% |

30,099 |

19.0% |

-3.6% |

|

Amazon |

13,646 |

9.0% |

13,235 |

8.4% |

3.1% |

|

Lenovo |

11,558 |

7.7% |

17,467 |

11.0% |

-33.8% |

|

Huawei |

6,287 |

4.2% |

9,189 |

5.8% |

-31.6% |

|

Others |

29,454 |

19.5% |

27,253 |

17.2% |

8.1% |

|

Total |

150,813 |

100% |

158,289 |

100% |

-4.7% |

Dostawy komputerów Chromebook - Canalys - Q4 2022

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

HP |

1,021 |

28.6% |

471 |

11.9% |

116.8% |

|

Acer |

710 |

19.9% |

910 |

23.0% |

-22.0% |

|

Lenovo |

550 |

15.4% |

749 |

19.0% |

-26.6% |

|

Dell |

479 |

13.4% |

641 |

16.2% |

-25.3% |

|

Asus |

456 |

12.8% |

722 |

18.3% |

-36.8% |

|

Others |

357 |

10.0% |

457 |

11.6% |

-21.9% |

|

Total |

3,573 |

100% |

3,950 |

100% |

-9.5% |

Dostawy komputerów Chromebook - Canalys - 2022

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Acer |

4,251 |

24.0% |

5,159 |

15.2% |

-17.6% |

|

Lenovo |

3,711 |

20.9% |

8,136 |

23.9% |

-54.4% |

|

HP |

3,524 |

19.9% |

10,250 |

30.2% |

-65.6% |

|

Dell |

2,965 |

16.7% |

3,603 |

10.6% |

-17.7% |

|

Asus |

1,728 |

9.7% |

3,314 |

9.8% |

-47.9% |

|

Others |

1,553 |

8.8% |

3,519 |

10.4% |

-55.9% |

|

Total |

17,732 |

100% |

33,981 |

100% |

-47.8% |

Dostawy PC (dane razem z tabletami) - Canalys - Q4 2022

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

25,499 |

24.1% |

24,256 |

18.2% |

5.1% |

|

Lenovo |

17,942 |

17.0% |

26,500 |

19.8% |

-32.3% |

|

HP |

13,220 |

12.5% |

18,646 |

14.0% |

-29.1% |

|

Dell |

10,883 |

10.3% |

17,279 |

12.9% |

-37.0% |

|

Samsung |

8,308 |

7.9% |

7,862 |

5.9% |

5.7% |

|

Others |

29,793 |

28.2% |

39,079 |

29.2% |

-23.8% |

|

Total |

105,645 |

100% |

133,622 |

100% |

-20.9% |

Dostawy PC (dane razem z tabletami) - Canalys - 2022

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

87,864 |

20.2% |

90,007 |

18.0% |

-2.4% |

|

Lenovo |

79,290 |

18.2% |

99,667 |

20.0% |

-20.4% |

|

HP |

55,314 |

12.7% |

74,140 |

14.9% |

-25.4% |

|

Dell |

50,011 |

11.5% |

59,560 |

11.9% |

-16.0% |

|

Samsung |

32,156 |

7.4% |

35,637 |

7.1% |

-9.8% |

|

Others |

129,882 |

29.9% |

140,215 |

28.1% |

-7.4% |

|

Total |

434,517 |

100% |

499,226 |

100% |

-13.0% |

Dostawy tabletów - dane IDC - Q4 2022

|

Company |

4Q22 Unit Shipments |

4Q22 Market Share |

4Q21 Unit Shipments |

4Q21 Market Share |

Year-Over-Year Growth |

|

1. Apple |

22.5 |

49.2% |

17.5 |

38.3% |

28.8% |

|

2. Samsung |

7.7 |

16.8% |

7.2 |

15.8% |

7.1% |

|

3. Amazon.com |

2.5 |

5.4% |

3.6 |

7.9% |

-31.1% |

|

4. Huawei* |

2.3 |

5.1% |

2.5 |

5.5% |

-8.6% |

|

4. Lenovo* |

2.3 |

5.1% |

4.6 |

10.1% |

-49.9% |

|

Others |

8.4 |

18.4% |

10.2 |

22.4% |

-17.3% |

|

Total |

45.7 |

100.0% |

45.6 |

100.0% |

0.3% |

Dostawy tabletów - dane IDC - 2022

|

Company |

2022 Unit Shipments |

2022 Market Share |

2021 Unit Shipments |

2021 Market Share |

Year-Over-Year Growth |

|

1. Apple |

61.8 |

38.0% |

57.8 |

34.3% |

7.0% |

|

2. Samsung |

30.3 |

18.6% |

30.6 |

18.2% |

-0.8% |

|

3. Amazon.com |

16.0 |

9.8% |

16.1 |

9.6% |

-0.7% |

|

4. Lenovo |

11.6 |

7.1% |

17.7 |

10.5% |

-34.6% |

|

5. Huawei |

9.1 |

5.6% |

9.8 |

5.8% |

-7.0% |

|

Others |

34.0 |

20.9% |

36.4 |

21.6% |

-6.6% |

|

Total |

162.8 |

100.0% |

168.3 |

100.0% |

-3.3% |

Dostawy komputerów Chromebook - dane IDC - Q4 2022

|

Company |

4Q22 Unit Shipments |

4Q22 Market Share |

4Q21 Unit Shipments |

4Q21 Market Share |

Year-Over Year Growth |

|

1. HP Inc. |

1.0 |

28.5% |

0.5 |

9.9% |

116.7% |

|

2. Acer Group |

0.7 |

19.9% |

1.3 |

26.6% |

-43.4% |

|

3. Lenovo |

0.5 |

15.1% |

0.7 |

15.1% |

-24.6% |

|

4. Dell Technologies |

0.5 |

13.4% |

1.0 |

20.5% |

-50.7% |

|

5. Samsung |

0.3 |

9.3% |

0.7 |

14.7% |

-52.4% |

|

Others |

0.5 |

14.0% |

0.6 |

13.2% |

-19.9% |

|

Total |

3.6 |

100.0% |

4.7 |

100.0% |

-24.3% |

Dostawy komputerów Chromebook - dane IDC - 2022

|

Company |

2022 Unit Shipments |

2022 Market Share |

2021 Unit Shipments |

2021 Market Share |

Year-Over Year Growth |

|

1. Acer Group |

4.2 |

22.0% |

6.4 |

17.3% |

-33.8% |

|

2. Dell Technologies |

4.1 |

21.3% |

5.4 |

14.6% |

-24.3% |

|

3. Lenovo |

3.7 |

19.5% |

8.2 |

22.3% |

-54.4% |

|

4. HP Inc. |

3.5 |

18.4% |

10.2 |

27.8% |

-65.6% |

|

5. ASUS |

1.3 |

6.8% |

1.6 |

4.5% |

-20.9% |

|

Others |

2.3 |

12.0% |

5.0 |

13.5% |

-53.8% |

|

Total |

19.2 |

100.0% |

36.9 |

100.0% |

-48.0% |